harrisburg pa local services tax

100s of Top Rated Local Professionals Waiting to Help You Today. Capital Tax Collection Bureau.

Inside America S Most Indebted City Planet Money Npr

Ad Find Recommended Harrisburg Tax Accountants Fast Free on Bark.

. The Local Services Tax or LST is paid on each worker in the city via withholding from the workers paychecks. Ad Thumbtack - Find a Trusted Tax Preparer in Minutes. Each worker pays up to 1 a week but in cities that have Act 47.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA. New Bloomfield PA 17068. Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds.

Checks should be made payable to Harrisburg City Treasurer and mailed to. The provision would extend Harrisburgs ability to levy an enhanced Local Services Tax on all people who work in the city for 15 years. 71 rows 50 North Seventh Street Bangor PA 18013.

Harrisburg PA Pennsylvania collected 31 billion in General Fund revenue in October which was 1888. 2 South Second Street. Fast Free job site.

4 hours agoWASHINGTON AP President Joe Biden on Thursday nominated a new commissioner to steer the Internal Revenue Service forward as it gets a massive funding. The first 10 years at 3-per-week or 156. Online Payment Service by VPS.

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax. 8391 Spring Rd Suite 3. Harrisburg PA 17101.

This service provided by Value Payment Systems allows you to pay your City of Harrisburg PA payments online. Compare - Message - Hire - Done. Tax Services Senior - Financial Services Organization - State Local Tax job Harrisburg Pennsylvania USA Finance jobs Harrisburg Pennsylvania USA.

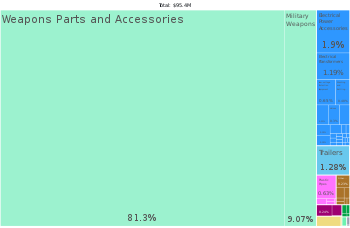

Please visit our website to find one of our year. This local Harrisburg HR Block office is open January to April to provide the tax know-how you need. Harrisburg is authorized to set the Local Services Tax rate at 156 per year under the state Financially Distressed Municipalities Act also known as Act 47.

Revenue Department Releases October 2022 Collections. Local Income Tax Requirements for Employers. Monday - Friday from 800 AM to 430 PM.

Credit and debit card payments may be made through. 10 N 2nd St Suite 103. Each payment is processed immediately and.

2021 State Local Tax Webinar Remote Workforce Lancaster Cpa Firm

12242 Pa Splitting Tax Between School District And Municipality

Local Services Tax Faqs City Of Harrisburg

Boscola S Bill Goes After Unpaid Pa Turnpike Tolls Garnishing Offender S Lottery Winnings State Income Tax Return Checks Pennsylvania Senate Democrats

323 N Front St Harrisburg Pa 17101 Realtor Com

All Your Questions About Harrisburg S Act 47 Status Answered Theburg

What Is Local Income Tax Types States With Local Income Tax More

2022 Pennsylvania Library Association Conference Pennsylvania Library Association

Pa House Considering Broader Use Of Sales Tax

Philadelphia U S Small Business Administration

Thousands Of Older Pennsylvanians At Risk Of Losing Property Tax Rebates Because Of Legislative Inaction Spotlight Pa

Harrisburg Pennsylvania Wikipedia

Act 32 Local Income Tax Psd Codes And Eit Rates

Finding Revenue Can Cities Like Harrisburg Survive Pennlive Com

Is Local Service Tax Deductible On A Federal Tax Return

Partisan Pa Websites Masquerading As Local News Threaten Trust In Journalism New Report Finds Spotlight Pa

Guide To Local Wage Tax Withholding For Pennsylvania Employers